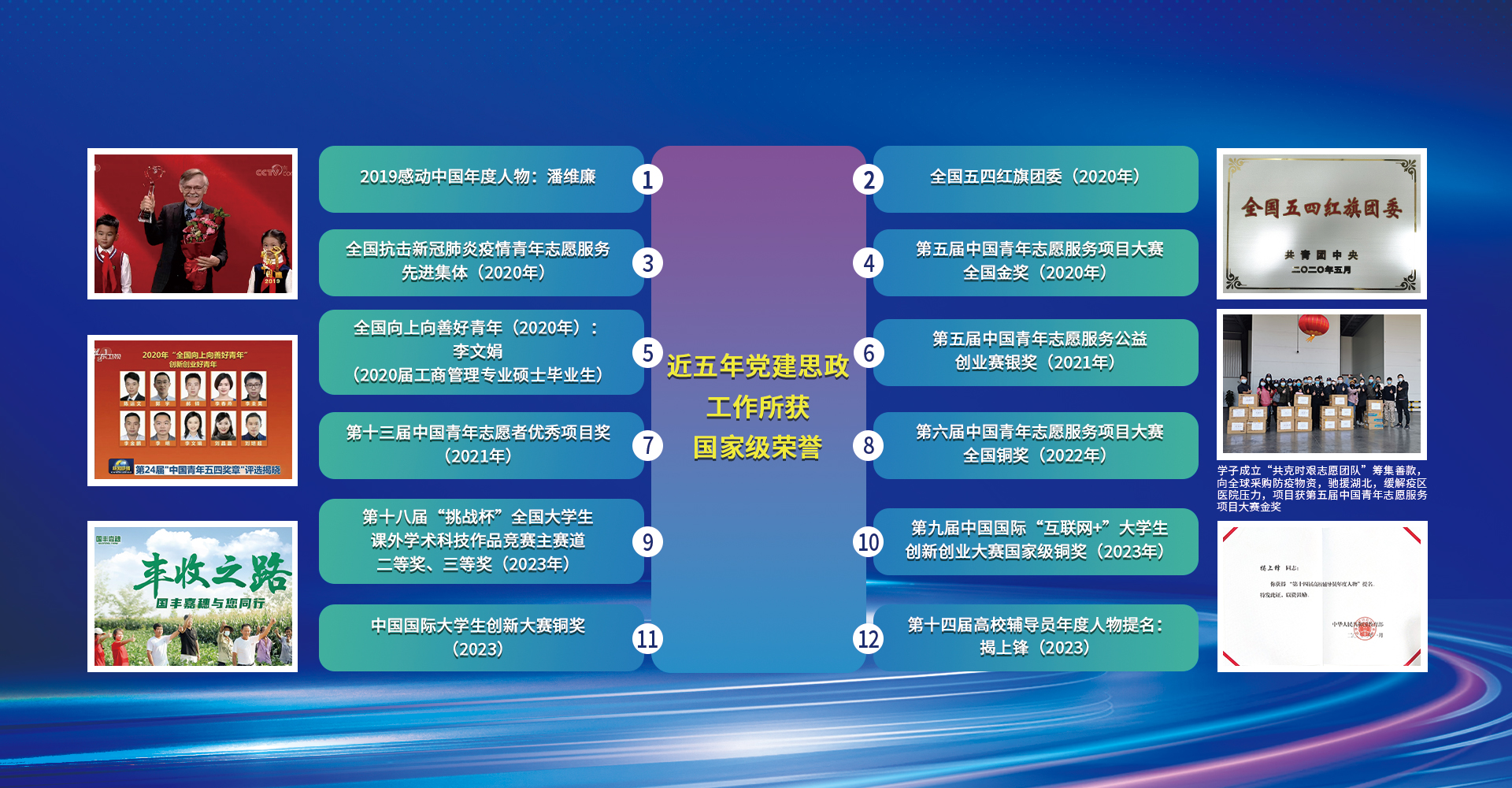

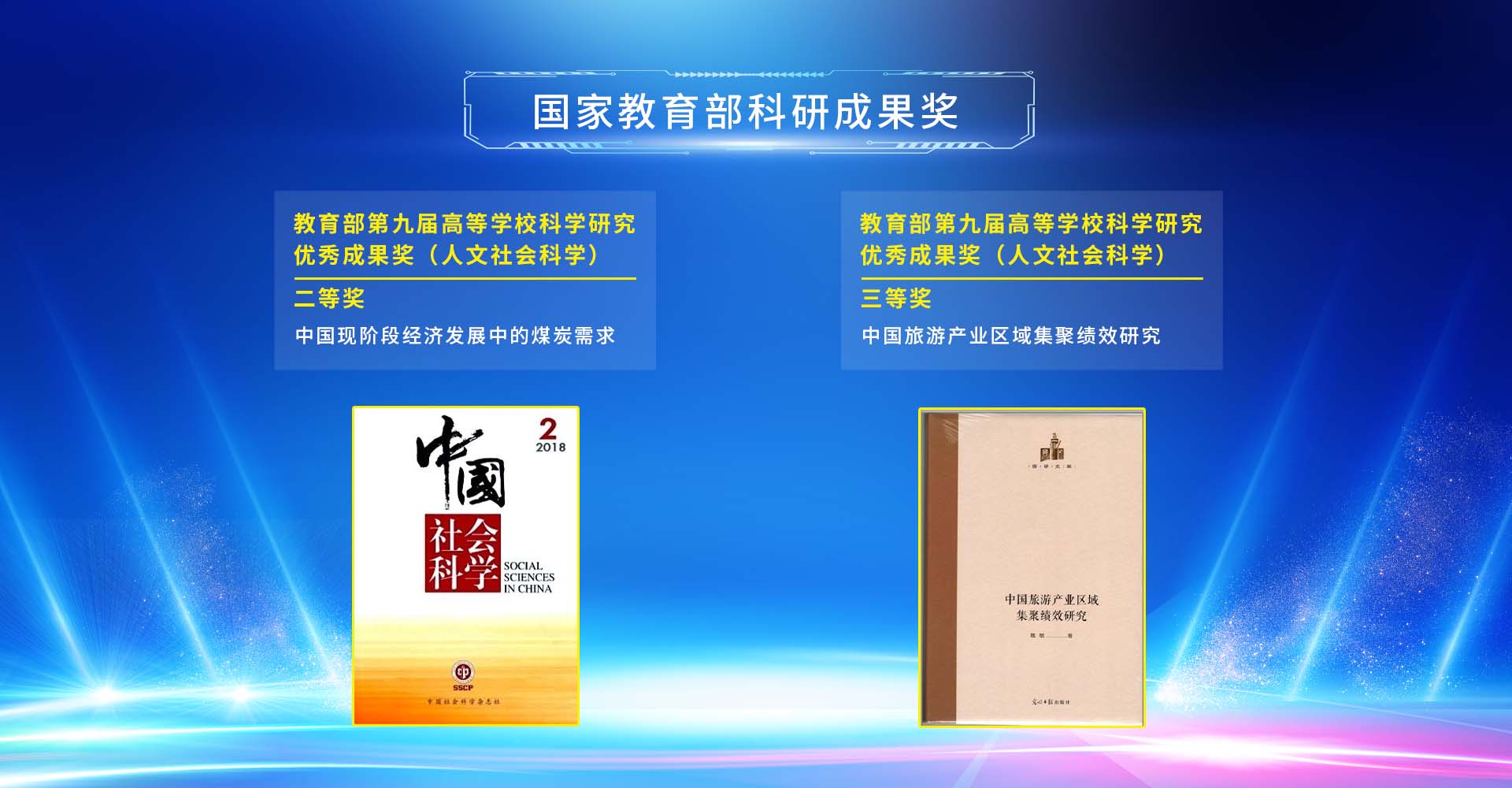

党建思政

学生动态

招生信息

教务信息

境外交流

30

2025-06

【相约管院】大礼包奉上,欢迎报考yl7703永利!

27

2025-06

超全!厦大管院双学士学位项目介绍(内附视频)

23

2025-06

yl7703永利推出"会计学/财务管理+AI"双学士学位项目

16

2025-05

yl7703永利2025年博士拟录取名单(第二批)

12

2025-05

yl7703永利2025年港澳台硕士(学术学位)研究生拟录取名单

08

2025-05

推开七扇门,预见你在厦大管院的星辰大海!

学院影像

CopyRight ©2025 中国·yl7703永利(集团)官方网站-Official Website 版权所有

技术支持:IT支持部